Myriad Factors Conspire to Lower Submarine Bandwidth Prices

The wholesale bandwidth market has undergone a transformation over the past few years. While the wholesale capacity trade remains robust among carriers, procurement by the largest content companies overshadows the industry. This shift has implications for traffic flow, exchange points, and pricing. Nevertheless, bandwidth prices continue to erode as volumes grow — even as the mix of market participants evolves.

Ownership Evolution

Content network operators account for a growing proportion of bandwidth on global routes, reducing the relative scale of global carriers. The largest among them, Google, Microsoft, and Facebook, are taking primary ownership shares of transoceanic systems, joining consortia and taking major stakes in carrier-owned cables.

By carrying traffic on their own networks, content network operators remove a large swath of global bandwidth from the addressable wholesale lease market for carriers selling managed bandwidth. Intense competition for the remaining lease business drives price erosion in the wholesale market. These content network operators avowedly do not resell their bandwidth, but they do swap capacity. This extends the addressable market pressure and price erosion beyond where individual content operators have taken a specific stake in a system.

Several factors drive the emergence of content distributors as network operators and bandwidth owners in their own right. One is simply the huge scale of bandwidth demand warrants network ownership and operational control. Another is achieving lowest bandwidth cost at the ownership level compared with purchasing managed bandwidth. To further enhance network productivity, content operators deploy specialized transmission equipment, optimized for interconnecting their data centers, on dark fiber where they can. A new generation of transmission hardware optimized for interconnecting data centers has emerged to meet this need, defining a new market for data center interconnect (DCI).

The ideal DCI topology differs from the traditional long-haul wholesale bandwidth trade between collocated carrier points of presence to data centers, as well as off-net transactions for B-end local access links to enterprise customer premises. Although carrier-oriented wholesale bandwidth vendors supply DCI, they adapt the traditional wholesale bandwidth topology accordingly.

Ownership Models

As the mix of submarine cable users and their needs evolve, so do the ownership models, which play a role in bandwidth pricing. Purely wholesale, carrier's carrier cable business models were left for dead following the capacity market bust in the early 2000s. Although investor-owned cables have continued to co-exist with the traditional model of carrier consortia-owned international cables, many have evolved to include the owner's internal traffic demand for Layer 2 and 3 services, as well as anchor tenants that take major autonomous stakes in the system, including entire fiber pairs.

One hurdle to joining a consortium or anchoring a new cable project to fruition is a substantial initial investment, which can exceed both the means and needs of many carriers that are otherwise interested in primary ownership of capacity on the system. This obstacle limits consortia membership, but subsequently establishes a reliable wholesale customer base. Vast potential capacity and requirements for diversity ensure ample capacity available for smaller purchasers.

In addition to large content network operators, traditional carriers, internet backbone providers, and retail service providers are also sourcing more capacity earlier in the development stage of submarine cable systems. For instance, primary stakeholders in AAE-1 are subdividing their stakes to other operators, including rights to continue upgrading the share as the system expands capacity. This satisfies an even greater number of carriers than are in the ownership consortium with committed capacity, shrinking the remaining wholesale market for managed wavelengths, while intensifying competition — and driving price erosion.

Technology and Cost Improvement

Transmission and switching technology advances increase capacity and network agility, lower cost per bit, and accommodate lower prices. As 100-Gbps line side deployments have matured, client-side wholesale transactions have increased. Still higher line rates of 200 Gbps or more will lower costs of 100 Gbps on the client side, and efficiencies in 100-Gbps transmission put pressure on 10-Gbps pricing in the meantime.

Along with bit rate, advances in switching and management make provisioning more agile, lower operating cost, and accommodate lower wholesale prices. Advances such as software-defined networking portend novel commercial models for on-demand bandwidth and entirely new pricing regimes to complement leases and indefeasible rights of use (IRUs).

One obvious requirement for the 100-Gbps proposition is demand for 100 Gbps on a single path, as opposed to an aggregate 10-wavelength purchase at 10 Gbps, which might include several diverse paths. But where operators need massive point-to-point capacity, managing one wavelength instead of 10 reduces complexity and cost. For instance, a 100-Gbps circuit requires one port and cross connect instead of 10 for an equivalent array of 10 Gbps ports.

Nevertheless, the large capital expenditure up front to deploy 100 Gbps on the client side provides a headwind against wholesale market adoption of 100-Gbps service. To maintain granularity, many wholesale buyers continue to purchase 10-Gbps waves even as single-path requirements exceed 100 Gbps. This headwind is weakening as 100-Gbps client side technology matures, including transceiver advancements that afford greater density and efficiency.

Large capacity increments like 100 Gbps raise the stakes for traffic protection and resilience. At the wavelength level, carriers generally trade in unprotected wavelengths, assembling redundant links between points to establish mesh networks and protect the traffic at Layer 3. Optical layer protection is also possible, and some carriers offer protected wavelength service, with pricing resembling traditional protection multiples that reach up to approximately 1.5 times the unprotected price. In the meantime, unprotected wavelength sales prevail, and 10-Gbps ports endure to ease the cost and ensure granularity of resilient mesh networks.

New Supply

New submarine cables inject large swaths of bandwidth into the market. This perpetuates a certain "lumpiness" to the balance of supply, demand, and price. But submarine cable projects have long lead times, and they drive market prices down even before they are ready for service. Owners of new systems garner primary customers with capacity pre-sales, and sellers on existing systems cut prices to lock in buyers before the new rival is operational. This mitigates price disruptions associated with particular new systems.

In the meantime, operators of existing systems deploy new technology that expands capacity supply. The emergence of coherent transmission and alternative submarine line terminal equipment (SLTE) vendors rendered unanticipated supply to owners of existing systems, leading to profound bandwidth price declines for buyers.

Upside surprises in technological capability aside, network operators face a basic challenge to balance capacity planning and provisioning. Underprovisioning can compromise business performance, while overprovisioning can drive oversupply, competitive intensity, and price erosion.

Price Trends

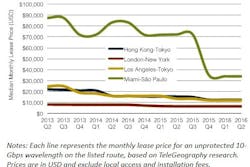

Bandwidth prices vary widely by region but show nearly universal decline. Price declines on primary subsea routes are greatest where absolute prices are high (see Figure 1). Among these core routes, the Miami-São Paulo median price declined most over a three-year period, 30% compounded annually, dropping from 11 times the trans-Atlantic price in 2013 to 6.8 times the price in 2016. Accordingly, trans-Atlantic prices exhibited modest decline over the period, compounding annually at 18%.

Figure 1. Price trends for 10-Gbps wavelengths on major routes, 2013–2016.

(Source: TeleGeography).

Regional Differences

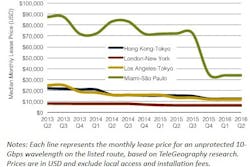

While bandwidth price declines are widespread, significant differences between regions persist, stemming from available supply and competition — on both international and domestic segments (see Figure 2). London-Mumbai shows both a high absolute price and high price per kilometer in Q4 2015 at $9 per kilometer, as does Miami-São Paulo at $5 per kilometer. At the other end of the spectrum, the transoceanic routes of London-New York and Los Angeles-Tokyo have the lowest prices per kilometer at $1.

Figure 2. Monthly lease prices by kilometer for 10 Gbps, major routes, Q2 2016

(Source: TeleGeography).

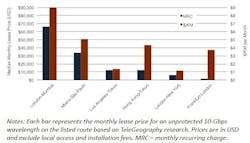

As demand for high-capacity circuits continues to increase, carriers are rapidly deploying 100-Gbps transmission technology across their networks, and pricing structures for the service have evolved. By Q2 2015, the multiple between 10- and 100-Gbps circuits was approximately 6.5, after starting out near 9.0 in early iterations. Capacity multiples for 100 Gbps skew low when sellers compete aggressively for 100-Gbps business but not for 10 Gbps. That is, a low 100 Gbps to 10 Gbps multiple can arise both from a relatively low 100-Gbps price or a high 10-Gbps price.

Outlook

Balance between supply and demand determines the rate of price erosion. Network operators have incentive to source as much capacity as early in the cable development cycle as possible to secure the lowest unit bandwidth cost. If many of these operators source more than they need and put the remainder up for sale, this intensifies competition and price erosion. But if operators balance individual capacity with internal demand, this early stage investment may actually have a stabilizing effect on pricing.

In the global bandwidth market, demand growth has proven just as reliable as price erosion. Beyond opportunistic transactions, the wholesale market is limited to specialist sellers with the constitution for very high rates of both volume growth and price decline, or with unique attributes that pose fundamental differentiation, such as access to emerging markets. Price declines are ultimately enabled by cost declines in both capex and opex, in turn driven by technology advances. Adept investment can keep abreast of cost decline and ahead of price erosion.

Erik Kreifeldt is a senior analyst at TeleGeography, a Division of PriMetrica, Inc. He began his career as a journalist and writer covering various aspects of optics before switching to the analysis field in 2000. He has been at TeleGeography since 2006.