by Stephen Hardy

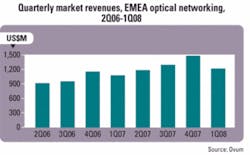

By all accounts, 2007 was the best year for optical networking equipment sales since 2001�and the Europe/Middle East/Africa (EMEA) market led the way. The region last year accounted for 36% of all sales of optical networking equipment (a category that includes metro and long-haul gear, but not FTTH, for most analysis firms), according to Infonetics Research (www.infonetics.com). EMEA edged out North America for the top spot by two percentage points. Ovum (www.ovum.com) concurred with this assessment of the region's strength, putting sales for 2007 at $5 billion. This figure represented an increase of 35% over 2006 spending, according to the research firm.However, 2008 isn't off to an equally impressive start, at least when you compare revenues quarter-to-quarter. Seasonal slippage from the fourth quarter of one year to the first of the next is usually expected�but is that all that's behind the reduction in spending in 1Q08? According to sources at both Infonetics and Ovum, the final size of EMEA's appetite for optical equipment this year will depend on several factors.

One of these factors is currency fluctuations. All research and analysis firms use a common currency to compare regional markets. For U.S.-based outfits, the common currency is naturally dollars. Given the fact that the euro's value against the dollar has skyrocketed recently, a dollar-based evaluation gives the EMEA market a natural boost.

Michael Howard, principal analyst at Infonetics, noted that when measured in dollars, the EMEA market dropped 25% quarter-to-quarter in 1Q08 (Ovum pegged the drop at 18%) but rose 19% compared to 1Q07. Ovum estimated year-on-year growth at 13%. But in either case, this increase could be deceiving.

"The euro has appreciated just about as much as the growth that we've seen in dollars," offers Dana Cooperson, vice president, optical networking, at Ovum. "So when you look in constant euros, the first quarter [this year] was a little bit down from the first quarter last year."

Cooperson cautions that it's easy to read too much into a single quarter's numbers. Yet she believes some new trends may be appearing this year. "One thing it could mean is that we are seeing some of the spending in Western Europe moderate a bit from what we've seen in the past," she explains. "And I think that's very likely. We've seen a lot of the growth move to the developing parts of EMEA�so Eastern Europe, the Middle East, Africa. So we do think that there's a fair amount of growth to go around that we haven't even seen yet in those other areas."

The bottom line, she says, is that "we do foresee continued growth, even if you take currency into account."

Howard and Cooperson believe many of the same drivers that have spurred optical equipment purchases elsewhere in the world�particularly a transition from SONET/SDH to Ethernet and WDM-based networking�are at play in EMEA, if not necessarily to the same degree. "Overall the EMEA trend is following a bit behind the [North American] lead of WDM growing faster than SONET or SDH," according to Howard, who noted, "[Service provider] spending on SDH is still bigger than WDM." Infonetics forecasts that WDM spending will finally surpass SDH outlays in EMEA in 2010.

While conceding that many of the same trends appear in all regions of the world, Cooperson notes that EMEA carriers currently aren't as concerned with video delivery as their counterparts elsewhere. FTTH deployments, particularly by incumbents, are in the nascent stages in most EMEA countries, where regulations may not provide much incentive for such carriers to embark on triple-play service delivery�or may bar them from doing so.

With video often not on the near-term requirements list, EMEA carriers have less need for the kind of flexibility and reconfigurability carriers elsewhere demand. According to Cooperson, this has led to less interest in reconfigurable optical add/drop multiplexers (ROADMs) than in North America, for example.

In fact, next-generation network planning in general appears to be at a pause, Ovum reports to its clients, thanks to changing product architectures�and continued high prices�in the nexus among SDH, WDM, and packet transport. Thus EMEA carriers tend to shy away from multifunction boxes. These include platforms that attempt to integrate multiple OSI layers�"They pretty much always say, �No, let switches and routers do what they do and let the transport gear do what it does. We want the flexibility to be able to respond to whatever our customers want,'" Cooperson reports�as well as packet optical network platforms.

"The way one carrier said it to me was, �We don't want the Swiss army knife�we want the toolkit,'" Cooperson relates.

But this doesn't mean there is no interest in advanced technology. "We've certainly seen a rise in any kind of Ethernet functionality in pretty much every box that's out there on the market," Cooperson says. "So maybe the ROADM bit hasn't clicked in yet, but certainly the packet piece is very strong. And the combination of SDH and packet processing is very much of an issue here."

Thus, although BT's 21st Century Network initiative may not be repeated throughout the region, next-generation networking is on the roadmap for large EMEA carriers; Cooperson asserts this will include ROADMs at some point, as well as 40-Gbit/sec links. The price of the technology necessary to complete this transition will likely affect its speed, however.

In addition to increases in WDM and Ethernet sales among the major carriers of Western Europe, Cooperson emphasizes much of the growth in EMEA will come from emerging nations or countries looking to overhaul existing networks. As mentioned previously, that means companies should look to Eastern Europe, the Middle East, and Africa for new pockets of spending.

Companies interested in the space must make it clear that they're committed to the region, however. Cooperson believes that one reason Chinese companies such as Huawei and ZTE have enjoyed success in emerging markets is their willingness to set up sales and support offices within the countries they serve. Carriers appreciate a demonstration that their equipment supplier will support them over the long term.

Finally, while the FTTH market remains in its formative stages in terms of incumbent deployments, it presents opportunities in and of itself as well as offering a harbinger of increased demand for metro and long-haul equipment. Of the 14 markets in which the Fiber to the Home Council asserts at least 1% of potential residential subscribers were directly linked with optical fiber in 2007, seven were in Europe. France has become a hotbed of activity, with multiple carriers announcing FTTH plans. Meanwhile, BT has announced a GPON trial that is slated to begin this month, and municipalities across the region have taken an active role in sponsoring FTTH deployments.

Like any market, the EMEA region presents unique challenges to equipment vendors. However, the analysts at Infonetics and Ovum agree that the region should continue to present a lucrative market for optical equipment sales for the foreseeable future.

Stephen Hardy is the editorial director and associate publisher of Lightwave.