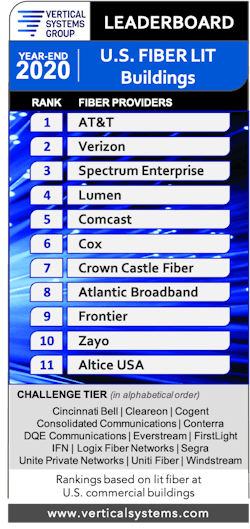

Vertical Systems Group (Boston, MA) announced that its 2020 U.S. Fiber Lit Buildings LEADERBOARD results are as follows, in rank order by number of on-net fiber lit buildings: AT&T, Verizon, Spectrum Enterprise, Lumen, Comcast, Cox, Crown Castle Fiber, Atlantic Broadband, Frontier, Zayo and Altice USA. Per the networking industry market research and strategic consulting firm, these eleven retail and wholesale fiber providers qualify for this benchmark with 15,000 or more on-net U.S. fiber lit commercial buildings as of year-end 2020.

Additionally, Vertical Systems Group announced that fourteen companies qualify for its 2020 Challenge Tier ranking as follows (in alphabetical order): Cincinnati Bell, Cleareon, Cogent, Consolidated Communications, Conterra, DQE Communications, Everstream, FirstLight, IFN, Logix Fiber Networks, Segra, Unite Private Networks, Uniti Fiber and Windstream. These fiber providers each qualify for the market research firm's 2020 Challenge Tier with between 2,000 and 14,999 U.S. fiber lit commercial buildings.

Commenting on this year's rankings, Rosemary Cochran, principal of Vertical Systems Group, said:

“The base of fiber lit buildings in the U.S. expanded in 2020, although the pace of new installations was hampered by the pandemic. Challenges for fiber providers ranged from impeded installations due to commercial building closures and business shutdowns to supply chain disruptions.

As the economy rebounds in 2021, fiber providers have opportunities to monetize the millions of small and medium U.S. commercial buildings without fiber, as well as larger multi-tenant buildings with only a single fiber provider. However, it remains uncertain how changes in U.S. regulatory policies and federal funding could alter fiber investments and deployment plans in the next several years.”

Other highlights of Vertical Systems Group's 2020 Fiber Provider research include the following:

- AT&T retains the top rank on the U.S. Fiber Lit Buildings LEADERBOARD for the fifth consecutive year.

- The threshold for a rank position on the 2020 Fiber LEADERBOARD is 15,000 fiber lit buildings, up from 10,000 buildings previously.

- Atlantic Broadband advanced to eighth position on the LEADERBOARD, up from eleventh in the previous year.

- Windstream and Consolidated Communications move into the Challenge Tier from the LEADERBOARD.

Vertical Systems Group’s 2020 U.S. fiber research analysis for five building sizes shows that fiber availability varies significantly based on number of employees. The study's Fiber 20+ segment, which covers four building sizes with twenty or more employees, has a 69.2% fiber lit availability rate. This compares to 14.1% availability for the Fiber <20 segment, which covers buildings with fewer than twenty employees.

Finally, Vertical Systems Group's Market Players rankings include all other fiber providers with fewer than 2,000 U.S. commercial fiber lit buildings. The firm's 2020 Market Players tier includes more than two hundred metro, regional and other fiber providers, including the following companies (in alphabetical order): ACD, Armstrong Business Solutions, C Spire, Centracom, CTS Telecom, Douglas Fast Net, EnTouch Business, ExteNet Systems, Fatbeam, FiberLight, Fusion Connect, Google Fiber, GTT, Hunter Communications, LS Networks, Mediacom Business, MetroNet Business, Midco Business, Pilot Fiber, PS Lightwave, Shentel Business, Silver Star Telecom, Sonic Business, Syringa, TDS Telecom, TPX Communications, U.S. Signal, Veracity, Wave Broadband, WOW!Business, Ziply Fiber and others.

Vertical Systems Group emphasizes that, for its analysis, a fiber lit building is defined as a commercial site or data center that has on-net optical fiber connectivity to a network provider’s infrastructure, plus active service termination equipment onsite. Excluded from the firm's analysis are standalone cell towers, small cells not located in fiber lit buildings, near net buildings, buildings classified as coiled at curb or coiled in building, HFC-connected buildings, carrier central offices, residential buildings, and private or dark fiber installations.