Optical networks' killer app: Streamed content

Have Asian telcos finally found the next killer app?

Skeptics persist, and real challenges exist, but streamed media over content delivery networks (CDNs) has real revenue potential for Asian telecommunications. And new revenue streams could not come any sooner. While broadband access has reached critical mass, it is barely profitable; the connectivity itself is commoditized in most markets. Broadband-enabled content services have far more potential than the pipe. As carriers like KT Corp. (formerly Korea Telecom), Japan's NTT, Taiwan's Chunghwa, and Hong Kong's PCCW pioneer this space, others around the world should watch carefully.

For the optical industry, there's an added benefit: Revamping telecom networks to support streamed content may create fresh demand for optical networking and support infrastructure. While CDNs are designed to push content to the edge—improving performance and reducing transport costs—as CDNs scale, the net effect is to spur traffic on metro core and access networks. The degree of growth is highly uncertain. In terms of traffic volumes, a vast gap exists between most likely and optimistic scenarios, the latter of which assumes heavy video usage (see Figure 1).There's also a need for new architectures and boxes; NTT, for one, is developing WDM-based passive-optical-networking technology. Vendors that develop metro boxes, including CWDM, that support Generalized MPLS, digital-wrapper, and Fibre Channel interfaces will benefit, as will those that work with service providers on customized solutions.

CDNs are not a new concept. Companies like Akamai used them in the mid-1990s to improve Website performance by distributing cached content closer to Web surfers. But CDNs are just one element of streamed content services. For telcos to become credible suppliers of streamed media, several things must come together:

- Critical mass of broadband users. Several million consumers with >1-Mbit/sec broadband access is needed to justify the telco investment, marketing expense, and content development. Japan, Korea, Taiwan, and eventually China and India are large enough to be standalone markets. Small markets like Hong Kong and Singapore, both of which are advanced in broadband and streamed media, compensate for their size by exploiting content synergies. Both are heavy users of international English and Greater China content; they also host companies that aspire to invest and expand across Asia. Markets like Thailand, Indonesia, and Malaysia are probably too small for now.

- Limited cable competition. Well-developed cable TV sectors in North America and Europe make telcos' efforts to compete in content that much harder. In Asia, though, cable networks are far smaller threats; digital broadcast satellite is a player but has quality problems. Hence, telcos' main competition is the wide range of offline alternatives to streamed content: pachinko parlors, DVD rentals, karaoke machines, gaming cafes, etc.

- Players and support servers. Media players themselves, and the related encoders, codecs, servers, development kits, etc., have evolved immensely in the last few years. Many service providers are crafting CDN offerings around Windows Media 9, which is several steps ahead of past versions (e.g., KT, Nifty, Avex).

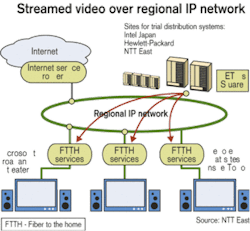

- Customer premises equipment and device partnerships. The old complaint—nobody wants to watch a movie on a 15-inch PC monitor sitting on a desk—is almost as valid now as before. So telcos' partnerships with electronics firms, aimed at integrating streamed Internet media with familiar customer premises equipment, are crucial for CDN success in consumer markets. KT, NTT (see Figure 2), and others in Asia, though, are offering streamed content that can be viewed and managed over conventional televisions via set-top boxes.

- Smart marketing. Video on demand and other convergence-based services have been touted before, to no avail. Consumers will have to be educated and excited to believe that this time is different and that what's being offered is worth the cost.

and highlighted pending releases: Chunghwa's multimedia on-demand service had launched in September, while PCCW's TV-based content delivery service starts this quarter. Real Networks, a content aggregator that also uses service providers for content sales, discussed its hottest content: sporting events, video-centric news, new music releases, reality TV shows, games, and pornography. NTT, spending billions of dollars to bring fiber to the home nationwide (using broadband passive optical networking and media converters—much cheaper than the earlier-favored optical access), opined that no killer app exists yet. Rather, it is government policy so far driving investment.

In reality, the streaming content platform itself may be the killer app. Its popularity will be driven by a number of much smaller services, mostly niche in nature, each of which has very different competitive dynamics. Pornography may have an early lead, just as it did with the dialup Web, but is hardly the only contender—and the field should level out over time. Whether a single type of content or network architecture or service package prevails remains to be seen. But if streamed media over broadband works, then the networks and revenue mix of Asian telcos could be reshaped permanently and give a much needed boost to post-bubble woes.Matt Walker is founder of MWL Consulting (Chiang Mai, Thailand) and an executive affiliate to market researcher RHK. He can be reached at [email protected] or +66 9 7000 499.