Growth in key segments boosts U.S. optical-component market

The recent selling off of stock in such optical-component giants as Nortel, JDS Uniphase, and Lucent should serve as a warning to investors and strategic planners, says a new report from Communications Industry Researchers Inc. (CIR-Charlottesville, VA). From now on, say analysts, Wall Street and optical-company management will have to look more carefully at where the real opportunities lie. Based on extensive interviews of major manufacturers, equipment vendors, and service providers, the new report highlights growth and trends in many optical-component categories, particularly optical switches, tunable lasers, and optical connectors.

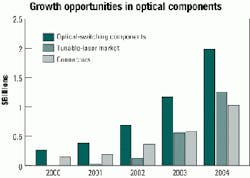

According to CIR, optical switches or crossconnects should begin to see significant deployments by service providers over the next year, which will result in increased revenue for manufacturers of optical-switching components. These manufacturers will also see demand and, subsequently, revenue rise for components used in optical add/drop multiplexing and protection switching applications. However, the report warns that integrated optical solutions from such vendors as Trellis Photonics and Optical Switch Corp. will increasingly challenge micro-electromechanical systems (MEMS), the current leading technology for optical switching. CIR forecasts that the U.S. optical-switching component and subsystem market, propelled by new trends in integrated optical solutions, should jump from $247 million to $2 billion by 2004 (see Figure).Tunable lasers represent another area of opportunity in the optical-component market. They enable service providers to decrease their laser inventories and offer improved fault and provisioning management.

The movement toward DWDM and all-optical equipment will result in significant opportunities for both large and small manufacturers of optical connectors. The optical equipment industry, hoping to build smaller footprints, is looking for smaller and smaller connectors.

The report, "Optical Components Markets: 2000-2004," examines the product trends and vendor strategies in critical areas of the components and subsystem industry. For more information, call (617) 923-7611 or visit www.cir-inc.com.