The roads both taken

Boyd Chastant

OnFiber Communications

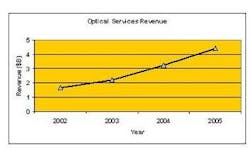

The vast majority of high-bandwidth services will be delivered via high-capacity, highly reliable fiber-optic-based services. The market for these optical services is expected to grow dramatically over the coming years (Figure 1).

Metro core avenue

To extend their networks into the metro core market, service providers looking for help from capacity suppliers must find a partner with the deepest possible footprint. With the collocation market extremely fragmented, a service provider's partners and customers may be spread throughout a metropolitan area. It is critical that the service provider select a supplier who has the greatest penetration in the metro core of the target market. This may be determined by identifying the number of carrier hotels and data centers that the capacity supplier connects within a metro region. It should also be noted that within many of these sites, the ability of a capacity supplier to deliver service beyond the suite in which their point of presence (POP) is located is often limited. Furthermore, these inside builds can often be extremely expensive.

Beyond the depth of penetration within individual metropolitan areas, the ability to offer coverage across all major metro areas is critical to increasing the overall addressable market and ensuring that large customers with a national presence can be served. Finally, service providers with a strong presence in the metro core and an ability to extend service into the metro access market will enjoy a key competitive advantage.

Metro access street

To extend networks into the metro access market, where carriers desire to provide services at T1 speeds or less, there is a wide range of choices. The regional Bell operating companies (RBOCs) have their embedded base of copper facilities, what competitive local exchange carriers (CLECs) remain are reselling on that base, and cable companies are beginning to provide some data connectivity services to businesses. Competition in this market should allow carriers to shop for the best values.

It is when the demands of the business customer exceed the T1 level that metro access becomes a challenge. While wireless solutions are available, the most reliable and stable means of delivering high-speed services is via fiber-optic connectivity. Unfortunately, with only approximately 5 to 10 percent of the buildings in the U.S. having access to fiber, it is difficult to find infrastructure providers in the metro access market that can provide a sufficient footprint to cover even a reasonable amount of this 5 percent, much less the ability to expand beyond it.

The RBOCs have the largest available footprint and the ability to deliver high-bandwidth services throughout their regions. The drawback to working with them, however, is the cost and the lack of flexibility of their services. The alternative is facilities-based providers with network construction expertise. These providers will not be able to offer the large geographic footprint of the RBOCs, but their agility will allow them to be extremely responsive and flexible in searching for the most economical solution for high-bandwidth requirements. Extremely knowledgeable providers can utilize available fiber from multiple sources, including their own custom builds, to create cost-effective solutions. The drawback is that many of these providers have fallen on hard times and are constrained by capital controls, which limit their ability to expand their networks even when presented with customers committed to providing revenue.

Crossroads

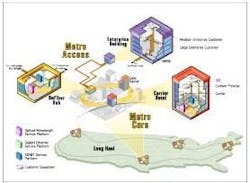

With the economy in the doldrums and substantial scrutiny being placed on the finances and business of service providers, carriers must cost-effectively serve the still growing demands for bandwidth. The solution is to utilize infrastructure providers who focus on the metro core and metro access markets (Figure 2). These providers allow carriers to extend their networks and increase the number of customers and locations they can serve without the need for capital expenditures. Carriers can therefore harness the bandwidth demand that is present throughout the metro to drive revenue onto their existing network infrastructures.

In selecting capacity providers to supply this metro connectivity, carriers must consider the number of sites the providers serve in the metro core, the ability of the providers to deliver high-bandwidth services in the metro access, the ability to offer a full range of transport services, and the financial position of the companies. Selecting a provider that can provide good coverage in the metro core and metro access markets offers the greatest possible addressable market for sales while also allowing carriers to minimize the number of overall suppliers they use.

Selecting the appropriate suppliers will maximize the reach of a carrier's network and put the company in an ideal position to aggregate more traffic onto their networks, increasing revenue streams as bandwidth demands continue to grow in the metro market.

Boyd Chastant is product manager at OnFiber Communications (Austin, TX).

Figure 2. The metro core is characterized by numerous carrier hotels and ISP POPs, no local access grids, and high-bandwidth optical services to traffic aggregation points. The metro access also has numerous carrier hotels and ISP POPs, but features local loop optical access services.