Active optical cable sales to outshine those of embedded optical modules: LightCounting

Embedded optical modules (EOMs) have supported supercomputers, core routers, and other applications since 2000; active optical cables (AOCs) arrived seven years later to offer a low-cost alternative to pluggable modules, particularly in high-performance computing (HPC) clusters. Despite being newer to the scene, AOC sales should prove more consistently strong over the next five years than those of EOMs, according to a new forecast from LightCounting.

AOC sales will benefit from their use in mega data centers, LightCounting believes. Thus, while demand for 40 Gigabit Ethernet (GbE) AOCs has peaked, 100GbE versions have arrived to keep the sales momentum going, thanks to increases in server interface transmission rates. Thus, LightCounting says it has increased its forecast for AOC sales this year; the market research firm now predicts the market will be worth $710 million by 2021.

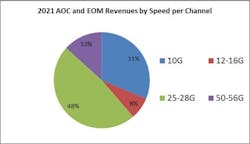

EOMs aren't used as broadly as AOCs and therefore will find the future a bit bumpier. LightCounting points out that the technology's more niche-based success has seen sales revenues peak in 2012 with a strong HPC market, slump in 2013-2014, and then recover in 2015. LightCounting likes the sales prospects for EOMs in the longer term, but expects the next two years will be comparatively slow. Overall, the market research firm predicts the combined EOM market will grow from $84 million in 2016 to $208 million by 2021. The figure above illustrates the forecasted breakdown of revenue by speed per channel.

LightCounting's combined "AOC-EOM Report and Forecast" tracks and forecasts 17 categories of products and maps them into five application segments: HPC, core routing, data center, optical backplanes, and mil/aero/other applications.

For related market research articles, visit the Business Topic Center.

For more information on interconnect products and suppliers, visit the Lightwave Buyer's Guide.