On-demand, end-to-end automation comes to custom pigtails and fiber assemblies

This automation technology exists today and OEMs should recognize and act upon it.

By SEBASTIAN SICARI

kSARIA Corp.

For many years it has been accepted that precision opto-electronic devices require custom hand assembly of key components, such as pigtails, laser chips, lenses, isolators, and other critical components. With part tolerances measured in sub-microns, fiber core diameters as small as 2.5-microns, and processes such as fiber attachment and polishing requiring painstaking precision, the idea of automating any part--never mind entire sequences of many processes--was considered out of the question.

Until recently, the only inroads achieved by automation were with individual processes, including fiber alignment, fiber/package bonding, and subcomponent pick-and-place. One area where automation had not been used with any success was the manufacture of fiber pigtails.

As shown in Figure 1, these complex fiber assemblies require multiple high-precision steps, including stripping, cleaning, ferrule attachment, polishing, connectorization and, in many cases, metallization. Except for some inconsistent semi-automatic bulk polishing of bundles of 12, 24, or 32 fibers, the ubiquitous fiber pigtail manufacturing process remained primarily a hand-assembly one. This has raised serious quality issues, forcing many original equipment manufacturers (OEMs) to resort to 100% inspection procedures that slowed manufacturing and increased costs.

Hand assembly, a traditionally expensive, time-consuming process results in spotty quality, long turn-around times, and the need to maintain large inventories to ensure uninterrupted manufacturing. Many OEMs resort to offshore contract manufacturing in an effort to reduce costs as much as possible. However, that incurs its own set of problems, including shipping and delivery issues, custom duties, international politics, communication challenges, and the tie-up of key engineering resources through extended travel to qualify offshore manufacturers.

In addition, hand assembly requires extensive training, prohibiting rapid scale up for high volume production. Relying on vendors who use hand assembly also drives up operating expenses, adding the high cost of incoming inspections, high inventory levels, returned material, and volume purchase agreements.

Scalability can also become an issue since scale-up often requires additional floor space, equipment, and skilled labor, while scale-down can result in hardships such as layoffs. The inability to scale quickly can equate to lost opportunities, market share, and revenue by not meeting time-to-market requirements.

Automation incentives

Despite all the disadvantages of hand assembly of precision fiber assemblies, stumbling blocks still remain in the efforts to move optical fiber component and assembly manufacturing to the next level. OEMs are still experiencing major "pains" that need to be addressed before progress can be made. They include:

• Aversion to volume production agreements (VPAs)

• Lack of confidence in quality resulting from the quality variance inherent in manual and semi-automatic batch manufacturing

• Higher cost of inventory maintenance as insurance against offshore supply disruption or delay

• Supply chain reliability and cost of supply chain management

Keys to true automation

Yet, until now, there has not been much to push the market toward automation. OEMs, relying on custom assembly, continue to design non-standard components, thinking that automation requires low mix/high volume production. Demand right now is weak, with high mix/low volume the rule of the day.

Companies outsourcing production with contract manufacturing are suspicious of volume commitments that come with even semi-automated assembly. Even with the low volumes currently in demand, OEMs are still concerned about future scalability and supplier responsiveness to higher volumes once demand picks up.

Regardless of current market conditions, a key telecom fiber expansion requirement is penetration into the metro access and enterprise areas. This requirement forces lower prices and lower operating expenses and is attainable only through automation enabling high mix/low volume. As volumes increase, the automation argument becomes even more compelling.

What's needed to make OEMs more innovative and competitive? What will provide the dynamics necessary to achieve true automation in fiber assembly--in turn, paving the way for metro access and enterprise market expansion and that "holy grail" of the optical networking industry, fiber-to-the-home (FTTH)? Several things, such as:

• Fully automated end-to-end fiber assembly process, from raw fiber on the reel to finished parts

• High mix/low volume capability

• On-demand manufacturing of assemblies

• Local manufacturer with "offshore" pricing

• Scalability to effectively respond to market fluctuations

• Product consistency, with repeatable quality metrics

• Significant cost reductions

Until now, the market reality of high mix/low volume has restrained the development of automation. What was needed was a broad, recipe-driven, flexible, automation platform with quick-change tooling enabling the use of a variety of fiber and ferrule geometries.

Such a platform would enable re-tooling times measured in minutes, rather than days or weeks, especially when operator training is involved. An in-line, end-to-end automated manufacturing platform in which processes are individually controlled in "one-up" processing instead of batch processing.

That's why a "one-up", end-to-end automated fiber assembly manufacturing process--from spooled fiber through polished ferrules and connectorization--has been developed and is currently supplying pigtail assemblies to OEMs. Providing full, raw-fiber-to-finished-component automation at the touch of a button has taken the assembly process from a manual or, at best, semi-automatic process to the highly flexible, high mix/low volume scenario providing the many benefits so eagerly awaited by the optoelectronics industry.

End-to-end automation benefits

This new process has already begun to yield the expected important advantages over manual custom assembly and the use of offshore contract manufacturing. Suppliers, using automation with quick-change tooling, enable their customers to react quickly to market fluctuations and high product mix.

Pre-qualified assemblies can be turned around in 24 to 48 hours, limiting the need to maintain inventory and encouraging high mix/low volume manufacturing without suffering higher manufacturing costs and delays. In fact, a comparison of the average manufacturing costs of U.S. domestic custom assembly and full automation reveals the potential for some astonishing cost reductions--up to 70% savings for a finished pigtail assembly. Design-for-manufacturing assistance, improved communications, and quicker response times also help to further reduce fiber assembly cost and improve product reliability.

By automating the entire process, including cleaving, alignment, attachment, bonding, and polishing, product consistency and reliability are almost guaranteed. In many cases, it also eliminates the need for 100% incoming inspection and enabling dock-to-stock use.

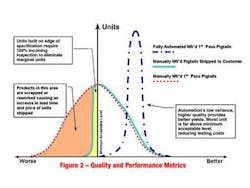

As Figure 2 illustrates, automation not only yields a higher performing quality product, the resulting reduction in lead times (from weeks or months to days) significantly improves inventory maintenance providing better materials management and enabling further cost containments. The recent breakthroughs in fully automated manufacturing of fiber assemblies--specifically, pigtails--provides OEMs with a wealth of benefits previously unavailable with hand assembly and semi-automatic batch manufacturing. They include:

• Lower unit prices and overall operating expenses

• Elimination of volume production agreements (VPAs)

• High mix/low volume production

• Unparalleled consistency and reliability

• Ship within 24-48 hours ARO

• Inventory reduction

• Time-to-market reduction

• Scalability

• Improved materials and intellectual property management

As the data and telecommunication industries move to increase and consolidate their use of optical fiber networks and systems, the key will be flexible, end-to-end automation to increase component availability and reduce costs. Only when on-demand automated manufacturing of custom components has been achieved will optical fiber expansion into the metro access, fiber-to-the-home, and enterprise markets be accelerated. The technology now exists to provide just such on-demand, end-to-end automation. It now requires OEMs to recognize and act upon this need for change.

Sebastian Sicari is president and chief executive officer at kSARIA Corp., headquartered in Wilmington, MA.