Worldwide fiber and cable: demand, production, and price

Worldwide fiber and cable: demand, production, and price

Despite softer demand and dwindling singlemode fiber prices in 1998, fiber-optic cable deployment is on a growth curve through 2002, especially in emerging markets and the Asia-Pacific region.

PATRICK J. FAY, KMI Corp.

Worldwide fiber-optic cable installation increased 14% to 44.1 million fiber-km in 1998, compared to 38.6 million fiber-km the year before. However, that increase is less than 1997`s growth, when deployment surged 23% from 31.5 million fiber-km in 1996. Yet, despite this slower growth, annual deployment worldwide is expected to reach 67.2 million fiber-km by 2002.

The United States, Japan, and China will represent 53% to 60% of installations each year through 2002, according to forecasts by KMI Corp. These three countries continue to dominate the market. In 1997, the "Big Three" accounted for 60% of fiber-optic cable installations worldwide. Thirty-two percent of all cabled fiber (12.2 million fiber-km) was installed in the United States. Japan, the next largest market, deployed 17% or 6.5 million fiber-km. China rounded out the top three with 11% (4.1 million cabled fiber-km) of the total market.

The Asia-Pacific region will have the strongest growth of the developed market regions (see Table). Led by China and Japan, this region will grow at the rate of 16% per year. This strong annual growth has seen the Asia-Pacific region surpass North America in overall annual volume since 1995. In 2002, the Pacific Rim region will consume more than 35.4 million singlemode and multimode fiber-km--almost twice the volume of North America`s 19.1 million fiber-km.

The worldwide market share of both China and Japan will increase by 2002, according to KMI forecasts. Japan will grow at a 16% average compound rate to represent 19% of the worldwide market with 15 million fiber-km. China will grow 23%--9% higher than the market average--and account for 12%, or 8.8 million fiber-km, of the worldwide total.

Although slower fiber-optic cable growth is expected in the United States, it will remain the single largest market by some 10% with 1.5 million fiber-km installations more than Japan in 2002. As its share of the worldwide market diminishes to 22%, U.S. fiber-optic cable installations will grow 8.4% per year on average, or 16.5 million fiber-km. Combined, the United States, Japan, and China will continue to represent more than half of all fiber-optic cable installations worldwide.

High growth in new markets

Emerging fiber-optic cable markets will post rapid growth through 2002. KMI forecasts a 24% compound average growth rate (CAGR) in Eastern Europe--the highest of all regions. Similarly, a 19% CAGR is expected in the following emerging markets: Africa, South Africa, India, Latin America, and the Middle East. The Asia-Pacific region shows a 16% CAGR. The Western European market is forecast at the worldwide average for the period with 14% CAGR. North America shows the slowest growth through 2002, at just 7% CAGR.

The Asia-Pacific region continues to be the leader in combined volume of singlemode and multimode cable installations. It will steadily grow to 35.5 million fiber-km in 2002, 85% larger than North America during the same period. Comparatively, the Asia-Pacific region was only 9% larger than North America in 1997.

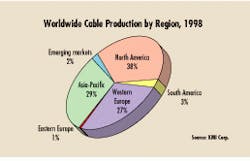

Worldwide cable production

Fiber-optic cable production in 1998 by region remained relatively unchanged from 1997. Of the 43.7 million km of fiber-optic cable manufactured worldwide in 1998, North America produced 38% (17.3 million fiber-km). The Asia-Pacific and Western European regions accounted for 29% (12.5 million fiber-km) and 27% (11.7 million fiber-km), respectively. The remaining 6% (1.9 million fiber-km) was produced in South America, Eastern Europe, and emerging markets, including Africa, South Africa, India, Latin America, and the Middle East.

In 1997, North America produced 39% (15.2 million fiber-km) of the 38.6 million km of fiber-optic cable manufactured worldwide. Of the North American total, 92% (14 million fiber-km) was cabled in the United States. The Asia-Pacific and Western European regions accounted for 29% (11.2 million fiber-km) and 27% (10.4 million fiber-km), respectively. The remaining 5% (1.9 million fiber-km) was produced in South America, Eastern Europe, and emerging markets, including Africa, South Africa, India, Latin America, and the Middle East.

More than 90% (35.7 million km) of the fiber-optic cable produced worldwide in 1997 was singlemode fiber used for terrestrial purposes. About 6% (2.4 million fiber-km) was devoted to multimode cable production. International submarine cable accounted for 594,000 fiber-km, or 2% of production.

Cablers by group

The top nine cable-making groups produced 79% (30 million fiber-km) of the 38.6 million km of cabled fiber in 1997 (the most recent year for which complete data is available). The top six cable-making groups in 1997 listed alphabetically are Alcatel, Corning/Siecor, Lucent Technologies, Pirelli, Siemens, and Sumitomo Electric Lightwave. Other major cable-making groups are Fujikura, Furukawa, and NK Cables. All of these groups operate multiple production facilities in two or more countries. Some groups participate in joint ventures as well.

The top four cable-making groups, Alcatel, Lucent, Pirelli, and Siemens, represented 44% of 1997 worldwide cable production, with each group having between 10% and 15% share. Market share is estimated based on production by individual facilities, with the facilities totaled for each group. For joint-venture facilities, the amount of cable assigned to each group is based on that group`s ownership stake.

Alcatel has the most facilities, with 25 fiber-optic cabling plants in 15 countries. Pirelli is next with 14 facilities in 12 countries. The largest cabling facilities are those of Alcatel in Claremont, NC; Lucent in Norcross, GA; Siecor in Hickory and Winston-Salem, NC; and Sumitomo in Japan. Each of these companies produced more than 2 million km of cabled fiber in 1997. Pirelli in Lexington, SC, and Fujikura and Furukawa in Japan all cabled more than 1 million fiber-km in 1997.

Altogether, KMI estimates there are more than 15 facilities that cable more than 500,000 fiber-km per year.

Worldwide fiber production by region

Fiber production in 1998 was significantly higher than the volume of cabled fiber sold and installed. On average, 10% of the optical fiber shipped to cablers is lost in the cabling process. Therefore, KMI used the following assumptions in its calculations: 10% loss for singlemode terrestrial cable, 8% loss for multimode cable.

Worldwide, 48.9 million km of fiber was produced and shipped in 1998. North America remained the largest producer of fiber in 1998 with 41% of the worldwide total, an output of 20.1 million fiber-km. The Asia-Pacific and Western Europe regions accounted for 28% (13.9 million fiber-km) and 27% (13.2 million fiber-km), respectively. South America and emerging markets produced the other 4% (1.7 million fiber-km).

Year to year, fiber production by region showed little change. In 1997, North America manufactured 43% (18.2 million fiber-km) of the 42.9 million worldwide. The output produced in Western Europe and the Asia-Pacific region was virtually equal. Western Europe manufactured 28% (11.8 million fiber-km) of the worldwide total. The Asia-Pacific region generated 27% (11.7 million fiber-km).

Fiber production by plant size

There are 55 to 60 fiber-manufacturing facilities worldwide. They range in size from more than 10 million fiber-km per year in 1997 produced by Siecor`s Wilmington, NC, facility to less than 50,000 fiber-km per year. The 10 largest facilities in alphabetical order are Alcatel-Claremont, Alcatel-France, Corning-Wilmington, Fujikura, Furukawa, Lucent, Norcross, Optical-Fibres (a BICC-Corning joint venture), Pirelli-UK, Siecor, and Sumitomo.

One recent strategy for entering the fiber production market is to set up "draw-only" facilities, meaning that a cable company or startup fiber company can draw fiber from purchased or transferred preforms. Essentially, fiber manufacturing consists of a two-part process: (1) making the preforms and (2) drawing the preforms into fiber. This draw-only process has given some cablers or startup fiber companies a strategy for entering fiber production without incurring all the preform and draw development and capital costs at the outset. KMI estimates that the amount of fiber drawn from purchased or transferred preforms is about 2.5 million fiber-km in 1997.

Singlemode fiber prices

Singlemode fiber prices have dropped dramatically since the fiber shortage ended in 1996. KMI obtained bare singlemode fiber price points from more than 40 cable manufacturers for 1996 through 1999. The data was collected in the first quarter of 1998. The actual prices paid by customers, however, may vary greatly based on volume and other factors.

The collected data indicates that regional price variations are converging--order quantity, duties, and import fees notwithstanding. Cable manufacturers confirmed this trend when KMI contacted them for updated price points.

This price convergence is due to the same factors that are influencing price erosion: excess fiber-making capacity, soft demand, and aggressive sales in new markets.

Worldwide market for optical fiber

Depending on the region, singlemode fiber prices declined 35% to 40% or 5.3 cents per fiber-meter in 1997 to 3.5 cents per fiber meter in 1998, according to KMI estimates. The 1998 average conventional singlemode-fiber price (CSMF) likely falls between 3.5 and 4 cents per fiber-meter. Based on several cabler inputs, the 1999 price for conventional singlemode fiber could fall below 3 cents per fiber-meter, but overall CSMF fiber prices likely will be between 3 and 3.5 cents per fiber-meter.

The price erosion of bare conventional singlemode fiber, which accounts for 90% of the worldwide cabling requirement, caused the optical-fiber market to decline 8% in 1998 to $2.59 billion from $2.84 billion in 1997. At the same time, the value of singlemode fiber declined from 85% of the total market in 1997 ($2.8 billion) to 75% of the market in 1998 ($2.6 billion).

Last year`s market decline follows a modest 3% rise in 1997 to $2.84 billion from $2.75 billion in 1996. Growth is expected to rebound this year by 1% to $2.63 billion, according to KMI estimates.

Worldwide market for fiber-optic cable

In 1998, the worldwide fiber-optic cable market--terrestrial singlemode, multimode, and international submarine--climbed almost 13% to $8.1 billion from $7.2 billion in 1997, according to KMI. The market in 1998 almost tripled compared to the 5% growth in 1997 from $6.9 billion in 1996.

The singlemode cable segment declined in 1998 to $5.2 billion from $5.7 billion in 1997. If the average cable price decreases by 15% to under 10 cents per fiber-meter as suggested by cabler inputs, the market downturn will continue in 1999, dropping to $4.2 million, according to KMI forecasts.

KMI incorporates long-haul, access, cable-TV, and "other" singlemode application estimates from approximately 50 countries, some of which use higher-margin specialty fiber. Long-haul installations in the United States, for example, use non-zero dispersion-shifted fiber exclusively.

Singlemode cable volume increased in 1998 to 40.5 million fiber-km from 36 million fiber-km in 1997 and is expected to reach 45.7 fiber-km in 1999. Last year, singlemode cable accounted for 92% of volume but only 50% of the market. In 1997, singlemode cable represented 93% of the volume and 78% of the market. The drop in percentage share in market value for singlemode cable in 1998 and 1999 is due to lower singlemode cable prices and increased volume of submarine cable, which can cost much more than singlemode cable.

Multimode cable increased 10% in 1998 to $795 million from $726 million, or 10% of the market, in 1997. Volume for both years was 6% of the total fiber-optic cable market. The submarine cable segment accounted for 35% of the market ($2.87 billion) in 1998. This segment is expected to grow to 43% ($3.84 billion) of the total fiber-optic cable market in 1999. q

Patrick J. Fay is an analyst with KMI Corp. (Newport, RI).