Cignal AI bullish on 400G coherent

Cignal AI doesn't believe coherent 400-Gbps technology will begin ramping significantly until next year – but it will prove more popular than the market research firm initially anticipated, according to the company's most recent "Optical Applications Report." Andrew Schmitt, lead analyst at Cignal AI, cites a growing number of applications for pluggable 400G ZR technology as well as improved performance from systems operating at 400G and greater across all distances.

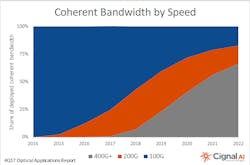

"Coherent 400G will cap the growth of existing 200G and 100G technologies by 2020 as new equipment becomes available that maximizes optical capacity independent of reach," said Andrew Schmitt, lead analyst for Cignal AI. "Compact modular equipment is the enabling platform, with revenue almost quadrupling in 2017, and we expect that it will continue to grow at least 40 percent per year through 2022."

That leaves vendors of 100G and 200G coherent to maximize their opportunities in the short term. The report indicates 200G technology accounts for more than 10 percent of the market, with Ciena and Nokia leading the way. Meanwhile, coherent 100G port shipment growth in North America outpaced that of the Chinese market during 2017 for the first time. However, price declines offset the increased port shipments, leaving revenue growth flat. The good news for suppliers is that Cignal AI expects a more stable pricing environment in 2018, leading to a brighter financial picture for vendors in the space.

The "Optical Applications Report" provides market share and forecasts for revenue and port shipments for optical equipment across such applications as 100G+ coherent, compact modular, and advanced packet-OTN switching hardware. Deliverables include an Excel file with the complete data set, a PowerPoint summary, and Cignal AI's "Optical Equipment Active Insight."

For related articles, visit the Business Topic Center.

For more information on high-speed transmission systems and suppliers, visit the Lightwave Buyer's Guide.