Labor, programming costs still hurt FTTP’s business case

Many business cases for FTTP have looked at deployments generically as if all providers face the same cost and revenue issues. In practice, there is a sharp difference between RBOC and IOC project financing costs. Importantly, the RBOCs do not have access to the federal, state, and municipal subsidies that have greatly reduced the cost of capital for small IOCs. Additionally, the RBOCs face much greater competition than rural providers that often have no cable provider operating in their serving areas.

While there isn’t an OSMINE certification requirement for small IOCs, many of these tiny providers must ask suppliers to certify on the Department of Agriculture’s Rural Utilities Service (RUS) list of accepted materials. RUS acceptance is part of a federal program to subsidize high-speed Internet access in rural areas.

Since the 2002 Farm Bill passed Congress, the Rural Utilities Administration has handed out more than $250 million in low-interest loans and loan guarantees to support broadband deployment. These funds have gone to both FTTH and remote DSL projects. Recent recipients include Red Oak Communications (Red Oak, IA), Hayneville Fiber Transport (Hayneville, AL), and Hood Canal Telephone (Union, WA). Expect to see their names in upcoming vendor press releases.

One of the reasons RUS-subsidized contract awards are so small is that the authority is prohibited from funding communities with more than 20,000 residents. Moreover, money is allocated to states that have a disproportionate share of communities with fewer than 2,500 residents. That partly explains why rural networks dominate FTTP deployments in the United States.

In the RBOC market, equipment purchases for new video services are generally expected to pay for themselves through revenue generation. Saving operational expenses is helpful, but new service introductions are not deemed successful because a few craft personnel are laid off. Another important consideration for the RBOCs is the internal rate of return (IRR) on video and FTTP deployments. Many vendors have built business cases around return on investment, which is far less important than IRR because it does not account for the time needed to earn a payback and cannot be used to measure returns over the corporate cost of capital.

While video services provide a new source of revenue for the RBOCs, financial gains from these services are cut back because of programming costs. These charges typically eat up one-third of all video revenue, and sports networks, which account for much of pay TV’s live content, are well aware of the leverage they have with content distributors. Nonetheless, many vendors still present business cases to carriers that ignore programming fees.

While equipment prices continue to drop, the labor costs to install the fiber still account for more than half the total cost to deploy FTTP. That has become a persistent challenge for the industry and is one of the main reasons SBC has retreated to bringing fiber to the node, not the home.

Verizon is still talking up FTTH, but its focus has been on small former GTE communities like Keller, TX, not the New York, Boston, or Washington DC metropolitan areas.

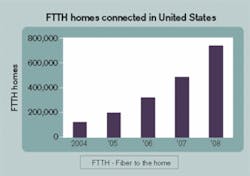

The optical-networking industry has swung dramatically between boom and bust over the last decade, but with over 100,000 homes now connected, fiber to the premises has been one of the few areas of slow and steady growth. However, the bandwidth advantage of fiber optics cannot reduce programming and labor costs, which remain major impediments to the successful FTTP business case.David Gross is research director, access networking, at Communications Industry Researchers (CIR-Charlottesville, VA).