Digital services drove 10% growth for hyperscale operators in 2024

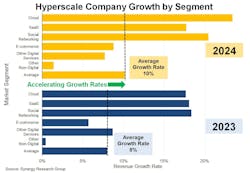

As cloud computing, social networking, and SaaS climbed in 2024, hyperscale revenues grew 10%, reaching $2.65 trillion, up from 8% in 2023.

Synergy Research noted that while hyperscale revenues from non-digital products and services grew by just 1% in 2024, their revenues from digital services grew by 13%.

AI continued to be a factor. The research firm said that in the cloud segment, generative AI platform services and GPUaaS more than doubled in size in 2024, with AI technology also helping fuel growth across a broad range of digital services.

From a company revenue perspective, Amazon, Apple, Google, Microsoft, Meta, JD.com, ByteDance and Alibaba remain the biggest hyperscale companies. Synergy said these companies now dominate the world’s IT landscape, accounting for the bulk of IT services, spending on IT hardware, and data center capacity. Together, they now have 1,149 hyperscale data centers in operation worldwide.

Further, CoreWeave, ByteDance, Meta, Microsoft, Google and Amazon had the highest growth rates.

Synergy's research was based on analysis and tracking data it has developed covering 20 of the world’s central cloud and internet service firms. These companies now have 1,149 hyperscale data centers in operation worldwide.

John Dinsdale, a Chief Analyst at Synergy Research Group, said that while industry watchers have raised concerns over hyperscalers' capex numbers, the justification becomes clearer when considering the scale and growth of the digital services these spending supports.

“They operate in capital-intensive infrastructure markets, where huge ongoing investments are essential to be leading players,” Dinsdale said. Despite this, their capex to revenue ratio was historically running well under 10%. 2024 saw this metric surge for some companies, but it was still barely over 12% in aggregate. Their digital service revenues will continue to grow at strong double-digit rates over the next five years, enabling them to continue funding necessary capex budgets.”

For related articles, visit the Data Center Topic Center.

For more information on high-speed transmission systems and suppliers, visit the Lightwave Buyer’s Guide.

To stay abreast of fiber network deployments, subscribe to Lightwave’s Service Providers and Datacom/Data Center newsletters.

About the Author

Sean Buckley

Sean is responsible for establishing and executing the editorial strategy of Lightwave across its website, email newsletters, events, and other information products.