Insatiable worldwide appetite for bandwidth to drive DWDM market through 2004

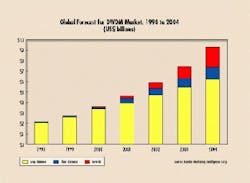

Sales of dense wavelength-division multiplexing (DWDM) equipment will rise from $2.2 billion in 1998 to $9.4 billion in 2004, according to a new study being released by Kessler Marketing Intelligence Corp. (KMI), a Newport, RI-based research firm specializing in fiber-optics markets. In its latest report, Worldwide Market for Dense Wavelength Division Multiplexing, KMI points to telecommunications market deregulation, decreases in prices for long distance, and Internet usage as the driving forces behind the world's bandwidth demand.

According to the report, growth in the market will decelerate from 32% in 1998 to 26% in 2004, for a compound annual growth rate (CAGR) of 28% over the six-year period. In terms of system sales, 1998 saw 94% growth with more than 4000 systems sold. In 2004, that number is expected to increase to about 42,000 systems sold, a CAGR of nearly 50% from 1998.

Long-haul carriers began placing DWDM systems in commercial service in 1996, and by the end of 1997, most major long-haul carriers had deployed DWDM, primarily in protected ring architectures with Synchronous Optical Network (SONET) equipment. Still, with data traffic growing at a rate of 100% or more each year, global fiber capacity continues to feel a strain. With DWDM systems, carriers can multiply fiber capacity by 40 times without the need to deploy new fiber.In 1998, the trend toward DWDM reached the competitive local-exchange carriers (CLECs), which began to deploy the technology in much the same way as their long-haul counterparts-to extend capacity on high-traffic backbone networks. Today, says KMI, systems vendors are looking toward deployment of DWDM in metropolitan area networks by CLECs and incumbent local-exchange carriers (ILECs). DWDM systems vendors are rapidly announcing and introducing products specifically designed for metropolitan-size applications.

Cost and compatibility with legacy systems have stalled DWDM deployment by ILECs, but new lower-cost products and software solutions moving into the market promise the adoption of DWDM by local carriers over the next few years. Vendors are improving the equipment required for local-carrier applications such as optical add/drop multiplexers and optical crossconnects. By 2004, short-distance DWDM systems will account for one-third of all deployed systems, up from 5% of the market in 1998.

The latest trend in DWDM deployment is transmitting Internet protocol over the optical layer without the electronic SONET layer. With issues of protection and survivability in a SONET-less system being successfully addressed, some carriers and vendors believe there will eventually be a migration to the all-optical layer for transmitting both voice and data. However, KMI believes that over the next five years, SONET and DWDM are likely to go hand-in-hand. Other key trends include:

- an acceleration in regional DWDM deployment in Europe and Asia

- a move toward "open" transponder configurations rather than "closed" systems in a single vendor's SONET equipment

- shorter-distance DWDM products gaining in market share as DWDM is adopted in metropolitan, enterprise, and premises applications

- laser retrofits to previously installed systems becoming a fast-growing part of the market, growing at a CAGR of more than 200% through 2004.

KMI's complete report is available by contacting the firm at tel: (800) 343-4035 or (401) 849-6771; fax (401) 847-5866; www.kmicorp.com; e-mail: [email protected].