1310-nm VCSEL-based transceivers emerge

While 850-nm vertical-cavity surface-emitting lasers (VCSELs) now dominate the market for short-reach applications, extended-reach VCSELs in the 1310-nm range have been slower to emerge, partly due to difficulties with the material structure of the devices. At OFC in March, however, Picolight (Boulder, CO) and Infineon AG (Munich, Germany) demonstrated the first working prototypes of 1310-nm VCSEL-based transceivers. It seems the technology has begun its migration from the lab to the exhibit floor at least, but how soon will it conquer the market?

In transceiver modules designed for longer-reach distances, the laser is by far the biggest single cost factor, reports Kai Siemer, worldwide product manager for Infineon's VCSEL devices. The great promise of VCSELs lies in their cost-cutting capabilities.Optically, the VCSEL performs very much like a distributed-feedback-style laser; it has a very narrow linewidth, and because it can be directly modulated, it features a very-high-quality optical output. While VCSELs are not the brightest laser technology available today, they are well suited for the vast majority of installed ports, which are less than 20 km. The 1310-nm VCSELs in development today are designed for the so-called "short metro"—Picolight's transceiver is optimized for 20 km, while Infineon's iSFP targets applications up to 15 km—a market in which edge-emitters have a significant headstart.

Warner Andrews, marketing vice president at Picolight is emphatically "bullish" about the potential impact of 1310-nm VCSELs, and Infineon's Siemer is quick to assert that "1310-nm VCSELs will follow a similar path of success" as their 850-nm predecessors. The VCSEL's cost advantages could do much to improve its position in the market. "Will the VCSEL parts that go into the transceivers that eventually end up on a board that eventually ends up in a system cost the RBOC less? Or will these savings only be seen by the systems people or the board-level people?" muses Stephen Montgomery, president of ElectroniCast (San Mateo, CA). "If the price is carried throughout the food chain, then, of course, the RBOCs will take a quicker look."

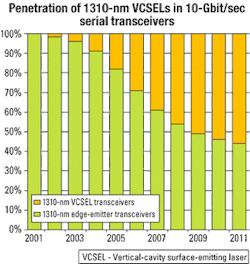

The shift from 1310-nm edge-emitters to VCSELs will not happen overnight, however. ElectroniCast expects that less than 1,000 units of 10-Gbit/sec 1310-nm serial VCSEL transceivers will be consumed this year. By 2006, edge-emitters will still dominate the market, as unit consumption volume of VCSELs will hover around 142,000. By 2007, however, consumption of edge-emitting versions will begin to slow down as a result of two key factors, says Montgomery. First, total quantity growth will be more modest after 2007, and second, competition from the lower-cost VCSELs will drive the cost of edge-emitters down as well. The total consumption value advantage will not shift to 1310-nm VCSELs until 2012, forecasts ElectroniCast.

This expected delay has caused some vendors to abandon ship. In January, long-time VCSEL champion Gore sold its 850-nm line to Optical Communications Products, which had previously purchased Cielo Communications' 1310-nm VCSEL assets. Bandwidth9 suspended its operations in February. On the flip side, Finisar recently closed its Demeter subsidiary, which produced edge-emitting Fabry-Perot lasers, and purchased Genoa Corp., which happens to be developing long-reach VCSELs.

Finisar now joins Picolight, Infineon, and several startups in the 1310-nm market, including E2O Communications (Calabasas, CA) and Lytek (Phoenix). Across the pond, VertiLas GmbH (Garching, Germany) and BeamExpress SA (Lausanne, Switzerland) are developing 1550-nm VCSELs. Is there room for everyone?

"Most of the 'throwing out of the bathwater' has already happened," reports Montgomery, "and we're pretty impressed with the companies that are out there now." In general, VCSEL vendors have been savvy about raising the requisite funds to wait out the downturn, he says, or they have found a "champion company" to act as their lead customer.