Communications services providers (CSPs) began 2020 with their sleeves rolled up, ready to innovate. Nobody, however, could predict just how much and how quickly that innovation would occur. An unforeseeable convergence of forces dramatically accelerated operators' adoption of multiple high-speed, customizable solutions and fast-forwarded both upstream and downstream broadband growth rates beyond even the most aggressive chief executive's wildest business plans.

That’s because when COVID-19 began its deadly global rampage, organizations responded by closing their office doors and instructing many employees to work from home. In fact, 62% of adults worked remotely due to coronavirus concerns in mid-April, according to Gallup Panel data. By comparison, 31% did so in mid-March and 49% telecommuted a few days later that month, the research firm found.

The Path Forward for Broadband

As COVID and related work-from-home regulations increased demand for better broadband, the industry had to take a serious look at making changes with the future in mind. They include:

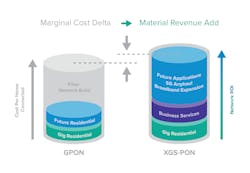

- An industry transition from GPON to XGS-PON

- Governments worldwide continued investments in FTTH

- Many national, state, and local government agencies' expressed preference for gigabit broadband

- Multiple global administrations have adopted digital transformation platforms

- CSPs continue to deploy open source, white-box solutions for agility, simplicity, choice, and cost

Getting to Generation XGS

Pre-pandemic, multiple forces already were reshaping telecommunications.

By year-end 2019, a great many CSPs were moving from GPON to XGS-PON and 4G to 5G. They were deploying fiber to densify their wireless networks. Simultaneously, many adopted data center architectures and investigated, piloted, or more fully embraced open source and open platform initiatives, including SEBA and CloudCO. These latter technologies became building blocks for more visionary and far-reaching change, such as supply chain diversification that lets CSPs choose from among multiple vendor partners and their products.

As a result of such changing CSP requirements, XGS-PON optical line terminal revenue increased 371% year-over-year and total XGS-PON OLT port shipments grew 222% year-over-year as more operators – large and small – continued their moves to 10-gig FTTH networks, Dell'Oro Group found.

"XGS-PON is the 10G PON technology of choice to serve both residential and business segments," added Broadbandtrends in its Global Service Provider 10G PON Deployment Strategies' survey from November 2019.

CSPs responding to the survey cited multiple reasons for migrating to the next-generation optical technology this year. For one, XGS-PON enables them to have a truly converged architecture that supports multiple applications and multi-gigabit residential broadband. The technology also enables CSPs to offer customers much higher speeds in the future – based on today's investments in technology, time, and education. In fact, most Broadbandtrends' survey respondents do not think there will be any need for PON bandwidth above 10G until 2024 at the earliest. When providers do need such capacity, they'll integrate that newer technology with today's 10G PONs, the research site said.

Meanwhile, some operators invested in XGS-PON despite having no short-term plans to offer 10-gig services, Julie Kunstler, principal analyst at Omdia, told Broadband Communities before the pandemic hit this year. It's easy to imagine at least some of those proactive providers tapped their high-speed, low-latency reserves to meet their newly expanded work-from-home market.

But CSPs weren’t the only agents of such changes. Many governments around the world set aside monies for fiber or high-speed wireless infrastructures, sometimes mandating higher minimum speeds than in prior years or requiring providers cover rural or lower-income urban areas as well as lucrative parts of a city or country.

Administrations in countries including Germany and the United Kingdom defined fiber-growth objectives and budgets; others, such as the United States, added more funds to their nationwide broadband coffers – specifically their fiber and 5G accounts.

For example, in January 2020, UK regulator Ofcom announced the long-predicted start of its fiber-first strategy, as well as the demise of the country's copper-based infrastructure (including investment in DSL and Gfast). While 95% of UK premises can get "superfast broadband" (24 Mbps or greater), primarily using fiber-to-the-cabinet via copper and fiber, the government's new goal is to deliver "gigabit-capable broadband" nationwide by 2025. Although 53% of UK homes can get "ultrafast broadband" (greater than 300 Mbps, but less than 1 Gbps), a mere 10% can access full-fiber, Ofcom's December 2019 Connected Nations report said. Still, that represents 3 million homes, almost double 2018's 1.6 million residences.

Operator BT, meanwhile, sped up its fiber deployment and plans to connect about 20 million premises by the mid- to late-2020s.

On the European mainland, Germany is extending fiber across the country, looking to at least directly connect fiber to all schools, industrial complexes, public-sector organizations, and hospitals in the next four years. Whereas some Tier 1 providers had extended the life of existing technologies by deploying Gfast and other DSL solutions, some – such as Deutsche Telekom – have embraced fiber, rolling out the asset across their footprint and planning to replace GPON with XGS-PON.

A bigger cause

Fiber is the conduit, but national broadband conversations are part of many governments' big-picture goal of digital transformation. They are re-engineering their countries' economies, cultures, and industries to leverage technological advances. In addition to providing fiber funds to operators and their customers (like municipalities, plus rural- or low-income housing developers), European governments want to meet Digital Agenda goals by 2025.

These aims include "better internet for all," coordinated 5G across Europe, free Wi-Fi access across the bloc, enhanced online security, and an online platform for conflict resolution across a plethora of issues, from government to commercial, the agenda says. It also addresses the need for network sharing, mutualized networks, and other ways in which telcos and governments can access infrastructure across borders and corporate walls.

Across the Atlantic Ocean, more than 85% of Americans now have access to fixed broadband at 250/25 Mbps, thanks in part to an $80 billion investment in network infrastructure in 2018, the Federal Communications Commission (FCC) wrote in its 2020 Broadband Deployment Report, released in April. Last year alone, 6.5 million homes gained access to fiber broadband; smaller CSPs deployed about one-fourth of this new infrastructure. Larger CSPs like Verizon, T-Mobile, and AT&T rolled out fiber to support 5G, with most U.S. urban areas now receiving the next-generation wireless speeds and more expected throughout 2020.

However, 5G densification is far from over. The top 25 U.S. metro areas need 1.4 million miles of fiber – and that's just for 5G. Over the next few years, the country has to invest up to $150 billion in fiber, Deloitte estimated.

"The secret for 5G coverage will be fiber. Areas will need the additional capacity fiber provides as well as to meet other performance goals related to network diversity, availability, and coverage," says Fiber Broadband Association CEO Lisa Youngers.

"We see this already in that cities that have invested in fiber are ahead of the adoption curve for 5G and smart-city applications," explains Youngers, "So the inverse is true: where there is little fiber, there is little 5G. And that could seriously limit the types of transformative and reinforcing development the world saw from 4G and the advent of the app economy.

"For 5G to work well, and to provide multi-gigabit service to many users and applications, mobile and Wi-Fi small cells must be connected to hundreds of thousands –perhaps millions – of miles of new fiber-optic cable. At least one estimate we have, we’ll need more than 265 thousand more miles of fiber cable to provide 5G service just to the top 25 urban areas in the United States," Youngers concluded.

Shipping packages

During the pandemic, CSPs saw a huge spike in use of both upstream and downstream data. Between March 12 and March 19, for example, Verizon says it saw voice usage grow 25% and total web traffic increase 22%. For the first 90 days of the U.S.'s COVID-19 response, the provider's customers used more than 10.3 trillion gigs of data – consumed for things like watching more than 87 million streams and accessing 4.8 billion page views, according to Verizon.

Agility was key to meeting this demand, CEO Hans Vestberg told CNBC. "In less than a week, we have transformed this company dramatically," he said. "We're always built for being prepared for different types of changes in the network, and that's why we're coping so good so far in the network."

Likewise, video streaming drove record data traffic at AT&T. Also up: Wi-Fi calling and wireless calling, along with traditional landline calls, the operator said.

Open to standards

The flexibility and adaptability that allowed providers to switch resources from enterprises to residential networks harks back, in large part, to their adoption of white-box servers and standards-based technologies. This choice opened a world of partnerships with best-of-breed vendors with differentiated products and services.

These more open, programmable architectures keep CSPs on the leading edge of innovation. They also add up to big savings: Operators have the "opportunity to take back ownership of [their] network from incumbents, and in so doing increase top-line revenue while reducing expenses by as much as 25-40%," wrote Timon Sloane, vice president of marketing and ecosystem at the Open Networking Foundation, citing data from ONF's 2020 State of the ONF report.

AT&T, Deutsche Telekom, and Telefonica pooled their open source education and financial models and shared the data with A.D. Little. The results? In addition to cutting costs, operators that embrace ONF or similar approaches for platforms for access and edge transformation can expect 11% top-line revenue growth, Sloane noted.

ONF partners developed SEBA, a Kubernetes-based lightweight platform built on a white-box server, that supports multiple virtualized access technologies at the edge of a carrier network. Because the design is optimized to run a fast path to the backbone without any virtual networks function (VNF) processing on a server, it's extremely speedy. SEBA also is operationalized with FCAPS and OSS integration, further reducing telcos' time and cost to deploy.

Open APIs and highly programmable technologies are key. With them, operators can extend the life of their current optical distribution network (ODN) with an architecture that delivers high-speed business, residential, and backhaul services.

Add XGS-PON-based 10G ONTs with flexible optics, and service providers now have an upgradeable path for current FTTH subscribers to move to higher bandwidths and backhaul offerings. Telefónica, for example, is using SEBA architecture – including a virtualized control plane – for converged residential, business, and mobile backhaul services, along with 10G PON OLTs that aggregate multi-vendor ONTs. The provider is migrating to a more flexible infrastructure across its entire global network that serves about 30 million homes. This step is designed to improve bandwidth, range of offerings, and support. The open, disaggregated network leverages SD-Access 10G PON using ONF virtualized access software.

The 'New Normal'

As the world adapts to a post-pandemic reality, CSPs that invest in open, programmable and disaggregated networks will react quickly or proactively to customers' needs. Whether that means giving enterprise-quality service and security to thousands of home-based workers, bringing educational materials to millions of students, or discovering new offerings that simplify lives or generate new revenue, the providers who act most rapidly and most sure-footedly are most prepared to succeed and thrive.

Gary Bolton is vice president, global marketing at ADTRAN.

About the Author

Gary Bolton

vice president, global marketing

Gary Bolton is the president and CEO of the Fiber Broadband Association.