The growing momentum around AI continues to affect the datacom optical market, as revenue grew for the fourth straight quarter.

According to Cignal AI’s 4Q23 Optical Components Report, the market is benefitting from what it says is an “explosion of demand for optics used in AI clusters.”

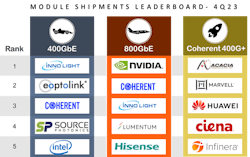

The research firm noted that Datacom revenue rose 11% YoY, and module shipments grew rapidly in the last two quarters of 2023 as AI demand accelerated. For all of 2023, total Datacom revenue was down -4%, weighed down by poor performance at the start of the year.

“Datacom shipments, especially 800GbE optics, are ramping up fast, and shipped units are forecast to reach 8 million in 2024,” said Scott Wilkinson, Lead Analyst for Optical Components at Cignal AI.

However, Wilkinson noted, "Telecom is slowly recovering from a bottom in Q3, but no immediate reversal is in sight.”

400 GbE, ZR, ZR+ variances

A notable segment was 400G. After declining at the beginning of 2023, 400GbE port shipments recovered and grew over 50% year-over-year in the fourth quarter of 2023.

Coherent port shipments increased QoQ, but they were down slightly year-over-year. 400ZR/ZR+ shipments grew 25% quarter over quarter.

Cignal AI sees more significant potential in the optical component and pluggable optics segments.

The research firm said the high-speed Datacom optical component market is forecast to exceed $10 billion by 2025, and the market for embedded and pluggable coherent optical modules will exceed $6 billion in 2024.

800G, 1.2 Tbps show potential

The market for 800G and 1.2 Tbps is also gaining some traction.

In the fourth quarter, Huawei, Infinera, Acacia, and Nokia shipped Gen120P 1.2T high-speed coherent ports for revenue. Cignal AI said this is the first quarter of production shipments of this new technology.

Based on accelerating demand, Cignal AI’s 2024 forecast for 800GbE modules was increased by 8%, and initial estimates of 1600ZR modules were also added to the Optical Components report this quarter.

For related articles, visit the Optical Tech Topic Center.

For more information on optical components and suppliers, visit the Lightwave Buyer’s Guide.

To stay abreast of optical communications technology, subscribe to Lightwave’s Enabling Technologies Newsletter.

About the Author

Sean Buckley

Sean is responsible for establishing and executing the editorial strategy of Lightwave across its website, email newsletters, events, and other information products.