Size, competition, R&D costs among optical component supplier challenges: LightCounting

Okay, so if bandwidth demands continue to climb and optical network deployment flourishes worldwide, why do optical component and module vendors have so much trouble making money? LightCounting lists several reasons in its new “The State of the Optical Communications Industry Report.” The list of potential solutions to low profitability among such optical technology suppliers isn’t quite as concrete.

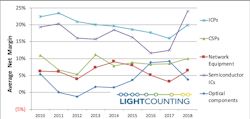

LightCounting points out that, as illustrated in the chart below, optical component and module vendors consistently rank at the bottom of the communications food chain when it comes to profit margin.

- The industry’s small size compared to its customers and the rest of the ecosystem. As the chart demonstrates, the total market share of component and module vendors pales in comparison to that of the other participants. That doesn’t give them much weight to throw around when negotiating prices.

- Another drag on prices is the difficulty in establishing competitive differentiation. Many products are based on standards or specifications established via multi-source agreements (MSAs). This factor accelerates the evolution toward commoditization.

- Nevertheless, the cost to design, develop, and produce such products (or, better yet, products where differentiation can be established) is large. The rules of the market make achieving significant return on investment difficult.

So, what can optical component and module vendors do to find more profit? In addition to finding a differentiable niche, such companies have to be selective about the opportunities they wish to pursue. LightCounting points to Lumentum’s recent decision to exit the datacom optical transceiver business as an example. Meanwhile, cutting costs becomes essential; LightCounting describes the outsourcing of manufacturing and other functions as a common approach, with the use of silicon photonics as another example of this trend. Finally, some companies (such as Lumentum and Finisar) are looking for new uses for existing laser technology, which explains the increasing interest among companies in supplying VCSELs in smartphone and automotive sensing applications. LightCounting points to the semiconductor industry, where the same core chip technology is used in multiple applications, as a model for this strategy.

LightCounting’s “The State of the Optical Communications Industry Report” offers an analysis of the global communications industry. It details revenue growth and profitability across different levels of the industry supply chain from 2010 to 2018 and identifies challenges and opportunities for the future. The report also includes a review of the latest mergers and acquisitions and their impact. It also covers the success of Chinese equipment and component suppliers.

For related articles, visit the Business Topic Center.

For more information on optical components and suppliers, visit the Lightwave Buyer’s Guide.

About the Author

Stephen Hardy

Editorial Director and Associate Publisher, Lightwave

Stephen Hardy is editorial director and associate publisher of Lightwave and Broadband Technology Report, part of the Lighting & Technology Group at Endeavor Business Media. Stephen is responsible for establishing and executing editorial strategy across the both brands’ websites, email newsletters, events, and other information products. He has covered the fiber-optics space for more than 20 years, and communications and technology for more than 35 years. During his tenure, Lightwave has received awards from Folio: and the American Society of Business Press Editors (ASBPE) for editorial excellence. Prior to joining Lightwave in 1997, Stephen worked for Telecommunications magazine and the Journal of Electronic Defense.

Stephen has moderated panels at numerous events, including the Optica Executive Forum, ECOC, and SCTE Cable-Tec Expo. He also is program director for the Lightwave Innovation Reviews and the Diamond Technology Reviews.

He has written numerous articles in all aspects of optical communications and fiber-optic networks, including fiber to the home (FTTH), PON, optical components, DWDM, fiber cables, packet optical transport, optical transceivers, lasers, fiber optic testing, and more.

You can connect with Stephen on LinkedIn as well as Twitter.