Reduction in service provider spending could lift in late 2021: LightCounting

LightCounting, in its October 2020 Optical Communications Market Forecast Report, has reduced its spending forecasts almost across the board. The market research firm says that a reduction in service provider spending worldwide necessitated by the economic realities of the pandemic likely won’t abate until late next year.

With revenues from both residential and enterprise customers on the skids, operators are addressing increasing capacity needs by adding linecards to their fielded equipment. But deployment of new systems has slowed, LightCounting reports. A robust economic recovery early in 2021 will be required to induce network operators to spend again at more normal levels. LightCounting’s team says it has therefore reduced the revenue outlook for almost all market segments it covers, including DWDM transceivers in 2021-2022; the FTTx and wireless fronthaul and backhaul segments were revised downward by 15-30%.

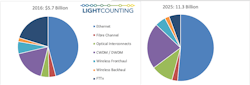

The exception to this hair cutting is optical interconnects, mainly active optical cables (AOCs). By beating the overall trend, such interconnects will become the third largest segment of the market by 2025 (see the graph above). And should service providers start spending at the end of 2021, they’ll look to catch up on the upgrades pushed out from this year, which bodes well for vendor revenue figures in 2022-2025. Overall, the Ethernet market segment should grow at 13% CAGR between 2020-2025 as well.

LightCounting’s October 2020 Optical Communications Market Forecast Report provides a market demand forecast through 2025 for optical components and modules used in Ethernet, Fibre Channel, CWDM/DWDM, wireless infrastructure, FTTx, and high-performance computing (HPC) applications. Key inputs include an analysis of the business and infrastructure spending of the top 15 service providers and of the leading Internet companies, and sales data from 2016 through H1, 2020 for more than 30 transceiver vendors.

For related articles, visit the Business Topic Center.

For more information on optical modules and suppliers, visit the Lightwave Buyer’s Guide.

To stay abreast of optical communications technologies, subscribe to Lightwave’s Enabling Technologies Newsletter.

About the Author

Stephen Hardy

Editorial Director and Associate Publisher, Lightwave

Stephen Hardy is editorial director and associate publisher of Lightwave and Broadband Technology Report, part of the Lighting & Technology Group at Endeavor Business Media. Stephen is responsible for establishing and executing editorial strategy across the both brands’ websites, email newsletters, events, and other information products. He has covered the fiber-optics space for more than 20 years, and communications and technology for more than 35 years. During his tenure, Lightwave has received awards from Folio: and the American Society of Business Press Editors (ASBPE) for editorial excellence. Prior to joining Lightwave in 1997, Stephen worked for Telecommunications magazine and the Journal of Electronic Defense.

Stephen has moderated panels at numerous events, including the Optica Executive Forum, ECOC, and SCTE Cable-Tec Expo. He also is program director for the Lightwave Innovation Reviews and the Diamond Technology Reviews.

He has written numerous articles in all aspects of optical communications and fiber-optic networks, including fiber to the home (FTTH), PON, optical components, DWDM, fiber cables, packet optical transport, optical transceivers, lasers, fiber optic testing, and more.

You can connect with Stephen on LinkedIn as well as Twitter.