IP over DWDM, coherent pluggables to hamper metro WDM growth: Cignal AI

The increasing popularity of IP over DWDM (IPoDWDM) and the related rise in reliance on coherent pluggable modules will dampen sales of standalone metro optical transport systems, according to a new report from Cignal AI. Systems vendors should begin feeling the effects in 2023, the market research firm predicts in its latest Transport Hardware Report.

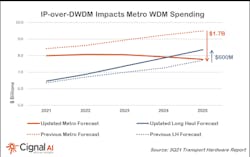

The expected trend toward IPoDWDM and coherent pluggables has led Cignal AI to cut its forecast for standalone optical transport equipment spending in 2025 by by $1.1 billion. This evolution should particularly affect standalone traditional and compact modular equipment that has traditionally complemented switches and routers. Sales of those platform should continue to grow, however, according to Cignal AI. As shown in the figure above, the company also expects continued sales expansion for open line systems and long-haul WDM, as well as direct sales of coherent optics to hyperscale operators.

“IP over DWDM is a concept two decades old, but technical compromises, operational challenges, and high cost have prevented its widespread adoption. Gen60C 400ZR/ZR+ pluggable optics can solve these problems with availability well-timed to the 400 Gigabit Ethernet investment cycle,” commented Kyle Hollasch, lead analyst for transport hardware at Cignal AI. “Hyperscale data center interconnect will drive early volumes, but service providers – who are responsible for 75% of optical capex - should get on board in 2023 as the cost savings of IP over DWDM becomes impossible to ignore.”

The new report focuses on activities in the third quarter of this year. Combined sales of optical networking and IP switching and routing shrank 2.5% during the quarter, thanks to double-digit declines in China for the second quarter in a row. On the positive side, North American sales increased for the fourth consecutive quarter and achieved the first quarter of year-on-year growth since the second quarter of 2020. Revenues from sales to EMEA also climbed compared to the year-ago quarter. Packet transport equipment sales in Japan also grew year-on-year by 10%.

From a market share perspective, Fujitsu and Cisco benefited most from the North American strength, while ADVA, Infinera, and ZTE saw their shares of the EMEA pie grow double-digits at the expense of Huawei and Nokia.

Cignal AI’s quarterly Transport Hardware Report examines optical and packet transport equipment revenue across all regions and equipment types. Equipment categories include metro WDM, long-haul WDM and submarine (SLTE) optical equipment, and access, aggregation, edge, and core packet equipment in six global regions. Vendors in the report include Adtran, ADVA, Alaxala, Ciena, Cisco, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper, Mitsubishi Electric, NEC, Nokia, Padtec, Ribbon, Tejas, Xtera, ZTE as well as others.

For related articles, visit the Business Topic Center.

For more information on high-speed transmission systems and suppliers, visit the Lightwave Buyer’s Guide.

To stay abreast of fiber network deployments, subscribe to Lightwave’s Service Providers and Datacom/Data Center newsletters.

About the Author

Stephen Hardy

Editorial Director and Associate Publisher, Lightwave

Stephen Hardy is editorial director and associate publisher of Lightwave and Broadband Technology Report, part of the Lighting & Technology Group at Endeavor Business Media. Stephen is responsible for establishing and executing editorial strategy across the both brands’ websites, email newsletters, events, and other information products. He has covered the fiber-optics space for more than 20 years, and communications and technology for more than 35 years. During his tenure, Lightwave has received awards from Folio: and the American Society of Business Press Editors (ASBPE) for editorial excellence. Prior to joining Lightwave in 1997, Stephen worked for Telecommunications magazine and the Journal of Electronic Defense.

Stephen has moderated panels at numerous events, including the Optica Executive Forum, ECOC, and SCTE Cable-Tec Expo. He also is program director for the Lightwave Innovation Reviews and the Diamond Technology Reviews.

He has written numerous articles in all aspects of optical communications and fiber-optic networks, including fiber to the home (FTTH), PON, optical components, DWDM, fiber cables, packet optical transport, optical transceivers, lasers, fiber optic testing, and more.

You can connect with Stephen on LinkedIn as well as Twitter.