Comcast Business advances to top rank on Vertical Systems Group’s 2024 U.S. SD-WAN LEADERBOARD

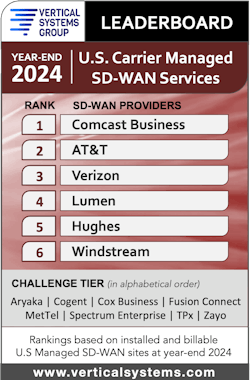

Comcast reached the number one ranking on the 2024 U.S. SD-WAN LEADERBOARD for the first time, showing ongoing shifts in the segment.

According to VSG, the company has steadily risen in the SD-WAN market segment from its eighth position in 2018.

AT&T, meanwhile, moves to the #2 position, following its hold on the top LEADERBOARD rank for the last six years.

Joining Comcast and AT&T were Verizon, Lumen, Hughes, and Windstream.

As of December 31, 2024, each service provider had four percent (4%) or more of the billable Carrier-Managed SD-WAN customer sites installed in the U.S.

“The U.S. SD-WAN market continues to expand despite several challenges for service providers and customers. These include ongoing platform updates, deployment of multiple SD-WAN solutions, and the confusion around SASE and SSE offers,” said Erin Dunne, director of research services of Vertical Systems Group. “SD-WAN service providers who managed these complexities and effectively scaled their offerings drove the shifts in the LEADERBOARD rankings.”

Cable’s aggressive rise

Comcast’s growth in the SD-WAN reflects the service provider’s ongoing commitment to expanding its business service capabilities via aggressive network builds into businesses.

The cable MSO has continued to make strides in the business services market through its own organic network builds and targeted acquisitions, such as Masergy and, more recently, Nitel.

By acquiring Masergy, a specialist in SD-WAN, unified communications, and cloud services, in 2021, Comcast enhanced its capabilities to serve large and mid-sized companies, particularly those with global operations.

Comcast recently purchased Nitel, deepening its cloud-based network capabilities. Along with its IT-managed network and security solutions, Nitel has 6,600 clients nationwide in financial services, healthcare, and education.

Jason Armstrong, Comcast's CFO, said during the company’s first quarter 2025 earnings call that the acquisition of Nitel advances Comcast's position to complete larger enterprises’ managed services opportunities.

During the first quarter, Comcast reported that Business services revenue rose 3.7% year-over-year to $2.5 billion.

“Our Enterprise segment is an even stronger contributor to growth, and one in which we are just scratching the surface,” he said. “Earlier this month, we closed on our acquisition of Nitel. This great tuck-in acquisition strengthens our ability to deliver advanced, reliable connectivity solutions, enhancing Comcast Business's competitiveness in managed services.”

While the Nitel acquisition could affect future SD-WAN standings, Rosemary Cochran, principal of Vertical Systems Group, said that since Comcast only completed it earlier this month, “their sites aren’t included in the Year End 2024 SD-WAN LEADERBOARD.”

In addition to taking charge of the SD-WAN market, Comcast and the cable industry are continuing to advance in the business segment, particularly in the Ethernet segment.

In its Year End 2024 LEADERBOARD, Spectrum Enterprise held the third position on the Ethernet LEADERBOARD, while Comcast was fifth.

Cochran noted, “Spectrum Enterprise and Comcast Business were the only LEADERBOARD companies with port share gains.”

Market shifts

During this reporting period for SD-WAN, there were other notable shifts.

Lumen advanced to the fourth ranking, which moved Hughes to the #5 position.

VSG noted that the 2024 LEADERBOARD roster will consist of six companies instead of seven, as Zayo dropped into the Challenge Tier.

Eight companies (alphabetically) attain a Challenge Tier citation for year-end 2024: Aryaka, Cogent, Cox Business, Fusion Connect, MetTel, Spectrum Enterprise, TPx, and Zayo.

Providers in this tier have a share of between one percent (1%) and four percent (4%) of U.S. Carrier-Managed SD-WAN sites.

Meanwhile, Market Players include all other providers selling Carrier-Managed SD-WAN services in the U.S. with a site share below one percent (1%), including global network providers that manage U.S. customer sites.

For related articles, visit the Business Topic Center.

For more information on high-speed transmission systems and suppliers, visit the Lightwave Buyer’s Guide.

To stay abreast of fiber network deployments, subscribe to Lightwave’s Service Providers and Datacom/Data Center newsletters.

|

|

About the Author

Sean Buckley

Sean is responsible for establishing and executing the editorial strategy of Lightwave across its website, email newsletters, events, and other information products.