Keep up to date with Lightwave’s earnings coverage.

You can check in our publication’s key segments:

And

And for more on Frontier, check out these articles:

· Frontier crosses 8M locations with fiber in Q1 2025

Frontier scales fiber customer base with 97K new customers in Q4

· Verizon’s CEO sees potential synergies from its pending Frontier acquisition

· Frontier sees broadband deployment savings potential in self-installs

Frontier, which is in the process of being purchased by Verizon, continues to push ahead with its fiber strategy with a footprint that now reaches nearly 9 million locations.

During the second quarter, Frontier added 334,000 fiber passings to reach 8.5 million total locations passed with fiber.

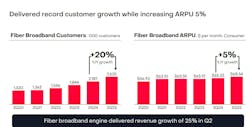

It also added 126,000 fiber broadband customers, resulting in fiber broadband customer growth of 20% year-over-year.

“We prioritize our activities to locations that we believe will provide the highest investment returns. As we implement our fiber expansion plan, we expect our business mix will shift significantly, with a larger percentage of revenue coming from fiber,” Frontier said in its second-quarter 10Q filing (PDF). “Our strategy focuses on four strategic priorities: fiber deployment, fiber penetration, improving the customer experience, and operational efficiency.”

Improving fiber product positioning

With its investment strategy focused on expanding its fiber network, Frontier is looking to improve its product positioning in its existing and new fiber markets.

As seen in its second-quarter results, it appears that the provider’s efforts are paying off.

For the three- and six-month periods ending June 30, 2025, Frontier added about 120,000 and 223,000 consumer fiber broadband customers, compared to 90,000 and 175,000 net additions for the three and six months ended June 30, 2024, respectively.

Likewise, Frontier saw churn decline. Frontier’s average monthly consumer fiber broadband churn was 1.29% and 1.25% for the three and six months ended June 30, 2025, compared to 1.40% and 1.32% for the three and six months ended June 30, 2024, respectively.

Frontier said this “improvement was driven by increased focus on key customer touchpoints such as installation and first bill, as well as inflation-related pricing actions and promotional pricing expiration.”

APRU also rose during the quarter. Average monthly consumer fiber broadband revenue per customer increased $3.22, or 5%, to $68.54 and $3.01, or 5%, to $68.40 for the three and six months ended June 30, 2025, respectively, compared to the prior year periods.

“The increase in consumer ARPU for the three and six months ended June 30, 2025, was due to customer shifts to higher broadband speeds, customers rolling off promotional pricing, and inflation-related price increases, all partially offset by increased retention activity and autopay take rates,” Frontier said.

Consumer customer gains

As it rolls out fiber to more locations, Frontier’s consumer customers rose 4%. Frontier attributes consumer gains to net additions of fiber broadband customers, partially offset by reductions in its copper broadband and stand-alone voice customers.

Driven by growth in fiber broadband customers, partially offset by losses in copper broadband, voice and video customers, Frontier gained about 51,000 and 90,000 consumer customers for the three and six months ended June 30, 2025, compared to a gain of approximately 14,000 and 25,000 consumer customers for the three and six months ended June 30, 2024, respectively.

“Customer preferences, as well as our fiber investment initiatives, increased the number of our consumer broadband customers and a migration of our customer base to fiber,” Frontier said.

For the three and six months ended June 30, 2025, Frontier experienced a net gain of consumer broadband customers of approximately 75,000 and 137,000, respectively, as compared to a net gain of roughly 40,000 and 74,000 for the three and six months ended June 30, 2024, respectively.

Consumer fiber broadband revenues increased 26% for both the three and six months ended June 30, 2025, as compared to the three and six months ended June 30, 2024. This improvement is a result of higher consumer fiber broadband ARPU as well as increased consumer fiber broadband net customer additions due to our expanded fiber footprint and continued focus on product positioning in both new and existing markets.

Consumer revenue of $825 million increased 4.6% year-over-year as growth in fiber-based products was partly offset by declines in copper-based products. Also, consumer fiber revenue of $609 million increased 16.4% year-over-year as growth in broadband was partly offset by declines in video

Frontier said the “revenue growth was the result of growth in fiber data and value-added service revenues along with inflationary price increases, offset by declines in voice, video, and copper broadband.”

Copper and fiber revenue battle

While it’s clear that Frontier’s fiber progression is on point, the service provider still faces the reality of declining legacy copper revenue.

For the three and six months ended June 30, 2025, Frontier lost approximately 45,000 and 86,000 consumer copper broadband customers, respectively, compared to a loss of roughly 50,000 and 101,000 for the three and six months ended June 30, 2024, respectively.

Frontier’s consumer copper broadband revenues declined approximately 17% and 18% for the three and six months ended June 30, 2025, as compared to the prior year periods.

Churn continues to be a factor. The service provider’s monthly consumer copper broadband churn was 2.26% and 2.16% for the three and six months ended June 30, 2025, compared to 2.02% and 1.98% for the three and six months ended June 30, 2024, respectively.

Frontier said, “the increase in consumer copper broadband churn was driven primarily by the impact of inflationary price increases.”

But with a mission to wire more locations with fiber, Frontier will continue to find ways to convert existing copper customers to fiber where it makes sense.

“As our copper footprint transitions to fiber, we expect fewer copper sales opportunities and will proactively migrate specific existing broadband customers from copper to fiber, both of which will reduce our copper customer base and revenues,” Frontier said.

However, Frontier emphasized that “customers who migrated from our copper base constituted a minor portion of these consumer fiber broadband customer net additions for the three and six months ended June 30, 2025.”

For related articles, visit the Business Topic Center.

For more information on high-speed transmission systems and suppliers, visit the Lightwave Buyer’s Guide.

To stay abreast of fiber network deployments, subscribe to Lightwave’s Service Providers and Datacom/Data Center newsletters.

About the Author

Sean Buckley

Sean is responsible for establishing and executing the editorial strategy of Lightwave across its website, email newsletters, events, and other information products.