Sales of optical network systems to North American cloud and colo providers jumps 50%: Cignal AI

Providing more detail on its previously released estimates of first quarter 2019 optical network hardware sales (see “Sales of compact modular optical systems grow as applications increase: Cignal AI”), Cignal AI reports that cloud and colocation network operators in North America increased their optical systems purchases by 50% during this year’s first three months. The market research firm notes in its newly released “Optical Customer Markets Report” that other customer segments should be expected to increase purchases this year as well.

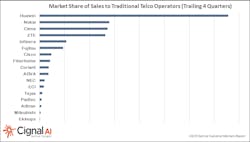

Cignal AI sees the activities of the North American contingent of the cloud and colo community during the first quarter of the year as part of a trend. “Optical spending in North America continues to shift from traditional telco providers to the cloud and colo operators,” explained Scott Wilkinson, lead analyst for optical hardware at Cignal AI. “Despite traditional telco operators accounting for most spending, the rapid growth in cloud spending combined with traditional operators now adopting cloud architectures has permanently changed supplier R&D priorities.”

Ciena, via its Waveserver Ai platform, has seen the greatest bounce from the cloud and colo spending boom. However, Cignal AI noted that new compact modular platforms were expected to reach the market during 2Q19, and thus the market research firm expects Cisco, Infinera, and Nokia to be among companies that will have seen stronger sales to this market niche during that quarter.

Elsewhere in optical systems sales…

Among other customer groups and regions, Cignal AI reports that traditional telcos (incumbent and wholesale network operators) in the Europe/Middle East/Africa (EMEA) region opened their wallets in 1Q19. The market research firm expects this segment to continue spending this year, to the tune of double-digit growth for 2019 in total. The outlook for spending from incumbents in Asia-Pacific isn’t as rosy, where Cignal AI see spending growth slowing.

The market research firm states in the new report that North American cable/MSO spending shrank during the first quarter. However, Cignal AI expects this to turn around, with sales to this segment growing moderately in 2019. The same can’t be said for the enterprise/government segment, where demand should remain repressed for at least the next two years.

The Cignal AI “Optical Customer Markets Report” tracks optical equipment spending by end customer market type. It provides forecasts based on expected spending trends by regional basis. The report includes revenue-based market size and share for all end customer markets across all regions.

For related articles, visit the Business Topic Center.

For more information on high-speed transmission systems and suppliers, visit the Lightwave Buyer’s Guide.

About the Author

Stephen Hardy

Editorial Director and Associate Publisher, Lightwave

Stephen Hardy is editorial director and associate publisher of Lightwave and Broadband Technology Report, part of the Lighting & Technology Group at Endeavor Business Media. Stephen is responsible for establishing and executing editorial strategy across the both brands’ websites, email newsletters, events, and other information products. He has covered the fiber-optics space for more than 20 years, and communications and technology for more than 35 years. During his tenure, Lightwave has received awards from Folio: and the American Society of Business Press Editors (ASBPE) for editorial excellence. Prior to joining Lightwave in 1997, Stephen worked for Telecommunications magazine and the Journal of Electronic Defense.

Stephen has moderated panels at numerous events, including the Optica Executive Forum, ECOC, and SCTE Cable-Tec Expo. He also is program director for the Lightwave Innovation Reviews and the Diamond Technology Reviews.

He has written numerous articles in all aspects of optical communications and fiber-optic networks, including fiber to the home (FTTH), PON, optical components, DWDM, fiber cables, packet optical transport, optical transceivers, lasers, fiber optic testing, and more.

You can connect with Stephen on LinkedIn as well as Twitter.